How to register a cash register in the tax. The procedure for registering a kkt, the necessary documents. Documents for registration of KKM

According to the new legal requirements, in Russia businessmen and entrepreneurs must have cash registers registered with the tax service.

We will tell you in detail how to register cash registers on the website of the tax authorities.

Cash equipment must comply with the requirements and norms of the current legislation. The cash register must be connected to the Internet, have modern software and be multifunctional and universal.

The Meta technical service center employs highly qualified specialists who will help you choose high-quality equipment for your type of business.

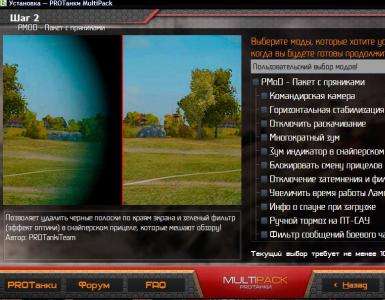

Stage 2. Modernization of the cash register

You can also modify an existing KKM model without buying a new one.

If you have not yet decided which option to choose, we advise you to familiarize yourself with. It will help you decide if your cash register can be upgraded.

If in doubt, call the consultants of the CTO "Meta".

Stage 3. Registration and execution of documents in the Federal Tax Service

Note that the registration procedure applies not only to the new online cash register, but also to the updated, old one. You still have to confirm the upgrade, too.

The registration procedure can take place in different ways:

- Personal appeal to the tax office. It will be necessary to prepare a written application and documentation package before going to the inspection.

- Registration of equipment through the website of the Federal Tax Service. You will need to register on the official website of the tax service and carry out transactions through your personal account. Remember, you must have received a UKEP (enhanced qualification electronic signature), otherwise it will not be possible to use this method.

- . Usually this service is paid.

- Registration of documentation through technical service centers. With this option, you do not need to deal with documents, as specialists will independently collect the necessary papers and send them to the Federal Tax Service. All you need to do is consent to this service.

When cash is taken in business for goods and services, a cash register is usually required. In some cases, you can do without it. New requirements require registration of cash registers. To do this correctly, you need to familiarize yourself with some of the nuances.

Who does not need a procedure?

Entrepreneurs who make payments in cash and bank cards use cash registers. But they are not needed in the following cases:

- work takes place on UTII or PSN;

- sold lottery tickets;

- sale of non-alcoholic products;

- catering for people studying and working at the school;

- sale of kerosene, milk, fish, vegetables;

- sale of goods at an exhibition, fair, market;

- acceptance of glass containers;

- at small retail sale;

- sale of postage stamps;

- sale of goods of a religious nature.

Where does registration take place?

The procedure is carried out in the tax authority at the place of residence. Legal entities should apply at the location of the organization. If they have divisions in which KKM is applied, then the procedure is considered mandatory in the tax authorities at the location. For example, if an LLC has several stores in different cities, then registration of cash registers in each city is required.

Individual entrepreneurs register a cash register with the tax office at the place of residence. Is there any liability if the application is not registered? A fine is imposed on individual entrepreneurs and LLCs.

Required documents

First you need to write an application for registering a cash register. Its form is approved by the Order of the Federal Tax Service of Russia. It is also necessary to attach documents for registering a cash register:

- device passport issued upon purchase of cash register;

- maintenance contract.

The agreement is concluded with the KKM supplier or with the technical service center. Documents must be submitted to the tax office in originals. If they are not there, then registration cannot be performed.

You also need to provide an IP document proving the identity of the IP. A legal entity must provide confirmation of the ability to act on behalf of the organization. If the documents are submitted by a representative, then he must have a power of attorney. The tax authorities are not entitled to demand documents for the premises in which the device will be used.

In practice, there are situations when they ask about such documents as a certificate of registration, registration. In order not to delay the procedure, it is advisable to find out in advance what documents are required.

Registration Features

Registration must be completed within 5 days of submission of tax documentation. Employees must notify the applicant of its receipt.

If defects in the documents are revealed, for example, something is missing, then it can be done within 1 day after notification. If you miss this period, then registration will be denied.

Equipment inspection

There is a generally accepted procedure for registering a cash register. This is established by law, and in case of non-compliance with the rules, liability is provided.

Before registration, the device is inspected. A specific time is assigned for this procedure. If it is not carried out, then registration will be denied. Inspection of KKM is carried out by a specialist supply or central heating.

Registration rules

If the equipment and documents have no comments, then the cash registers are registered. Information about the device is entered in the CCP accounting book, which is controlled by the tax authority.

The entrepreneur must provide a device passport, where a special mark is placed. After that, an equipment registration card is issued, an accounting coupon and documents. Employees carry out the certification of the journal of the cashier - teller. There is no service fee.

Requirements for KKM

You need to register only the equipment that is in the state register. The device must show details on the receipt, which may differ in each type of activity. Therefore, it should be considered in which industry the CCM will be used.

To use the equipment, you will need to conclude an agreement with a special company that will provide technical support for the equipment. Without this document, the device cannot be registered. A cash register without registration cannot be used.

Equipment selection

The device must be selected correctly. If the model is not in the state register, then it is forbidden to use such a technique. The device must have a hologram "State Register" with the designation of the year, number and name of the device.

The cash register receipt must contain the following information:

- name of the document with number;

- the date;

- full name of the entrepreneur;

- name and quantity of goods;

- sum;

- position and name of the employee.

There is one that does not have an EKLZ memory block. Such a device is not considered a CCP, so it will not be possible to register it. NIM is used by UTII and PSN payers.

Refusal to register KKM

The registration procedure may be refused if there are not enough documents, the entrepreneur does not appear to inspect the equipment. Other reasons include:

- appeal to the wrong tax office;

- false information in the application;

- finding KKM wanted;

- equipment malfunctions or lack of signs, seals;

- no access to the device.

Refusal to register may follow in the case of presentation of a device that is not included in the state register. This applies to the expiration of the KKM depreciation period. The main requirement, due to which registration takes place, is the inclusion of the device in the registry.

The exceptions are situations when the device has dropped out of this document. If such a device is registered, then it can be used until the end of the depreciation period (up to 7 years). But if KKM was purchased from someone, then it will not be possible to register it.

A used device can be registered at:

- changing the name of the organization;

- reorganization of a legal entity;

- change of location of the company;

- IP recovery;

- introduction of CCP into the authorized capital;

- registration of a legal entity by the founder of an IP.

For the use of the device with violations, liability is provided. Large fines are imposed on individual entrepreneurs and legal entities.

The operation of the equipment is 7 years, after which deregistration is required. For sale, cash registers are in a non-fiscal state, so the meter is turned off. The process of fiscalization is considered mandatory. When registering a supported device, you need to reset the fiscal memory.

When registering with a tax inspector, the serial number, TIN and the name of the organization are entered into the memory. Then a password is approved, which serves as protection against illegal entry into the device. Then the seal is installed, and the procedure is completed by the introduction of the amount. This is necessary to check the correctness of the details. The FTS inspector and the applicant sign the registration document. The cash register will have its own number, after which it is considered registered.

Do you conduct cash and non-cash transactions? Then cash registers are used. Consider what procedure should be followed when registering KKM in 2019.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

Companies and individual entrepreneurs, when carrying out activities related to cash settlements or accepting bank cards, must use cash registers.

General points

What is the essence of the use of cash registers - this needs to be figured out before how to maintain cash discipline at the enterprise.

What it is?

A cash register is a tool by which government agencies control cash flow, completeness and timely posting of revenue by companies.

Such equipment is used in order to simplify the accounting of goods and control sellers. Cash registers are used to pay for goods sold and services rendered.

The main task is to fix it on paper. KKM is an autonomous device on which cashiers collect the amount and punch checks.

KKM is not required to use such companies that are engaged in the following activities:

- trade in the market, an open area in a specially designated place (except for a kiosk, stall, shop);

- peddling trade from the tray;

- sale of tickets, periodical literature;

- trade in drinks on tap, fish, vegetables;

- acceptance of glass containers and disposal of raw materials, etc.

The main criterion for exemption from the use of CCP is the lack of access to the mains to ensure the operation of the device.

For what purpose is it carried out?

Why do I need to register KKM? Such devices are registered with the tax authority at the place where the company was registered. The process is required.

The point of sale is periodically checked by representatives of state authorities for the operability of cash registers. If violations are recorded, the organization may receive a large fine.

KKM is registered to ensure that the enterprise will use serviceable models of equipment that comply with the approved rules.

The procedure for registration of equipment is associated with the preparation of maintenance contracts with the central heating service. As a result, the machine is serviceable and undergoes systematic checks.

Legal regulation

The basic law that regulates the use of cash registers is. This regulatory document spells out the obligation to apply the calculations of devices included in the state register.

The legislation establishes the rules for accounting and maintenance of cash registers:

All equipment intended for cash transactions must have fiscal memory. The state has created a special register where cash registers are reflected, which are allowed for use.

All models belong to some types and the scope of their application is indicated. Since the registry is constantly updated, the first step before registration will be the selection of suitable types of devices.

The portal of the federal tax service has all the requirements that apply to cash registers. These are the conditions:

| Equipment must have a fiscal type of memory | Mandatory presence of a case, the ability to print a check and control tapes |

| Data that passes through the CCP | Must not be modifiable |

| Information must be kept for a long time | Regardless of energy consumption |

| All data must be displayed unchanged | On cash receipts and control tapes |

| It should be possible to introduce features of the mode | Which indicates that it is impossible to correct the data that is carried out using a payment card when paying in cash |

| It should be possible to extract information | What is reflected on the control tapes and in the fiscal memory of the KKM |

| Must have a watch | What reflect the real time on the check |

| It should be possible to enter | Information about users in the fiscal memory of equipment |

| Machine must be in good working order | — |

| Must have lock function | If there is no data on the fiscal regime on the cash tapes |

| Worth having | All necessary documents, etc. |

Registration of KKM in the tax in 2019

KKM must be entered into the register of tax authorities without fail.

Checking structures have several infobases, one of which contains information about registered equipment, and the other contains lists of models that are prohibited for use due to obsolescence.

So, at the selection stage, such information should be clarified so as not to purchase a prohibited device. When registering KKM in the state register, they reflect the following information:

- brand;

- manufacturer's name;

- information about the possible version of the software;

- activities;

- tax regime;

- maximum terms of initial registration.

If you want to register urgently, you should consider:

List of documents

When purchasing a cash machine, it is worth presenting:

- Full name or company name;

- OGRN;

- contacts.

To register a cash register, you need to prepare the following documentation:

- Application to the representative of the tax service that will conduct registration.

- Certificate of registration in the department of the Federal Tax Service.

- A certificate stating that the property is being used legally.

- Certificate of registration with the Ministry of Natural Resources.

- Lease certificates or proof of ownership.

- Forms of cash registers.

- The technical passport of the car that is being registered, with a seal and signature (it is filled in by a representative of the tax service).

- Acts that are drawn up before using the machine.

- A journal that records visits to central heating workers.

- Payment documents that will confirm the purchase of KKM, payment for contracts with the CTO.

- Printed magazines of cashiers.

- Reporting balances.

The person responsible for carrying out the procedure is the representative of the enterprise or its owner.

When acquiring a cash register and a magazine used when maintaining a cash desk in the TsTO, certain documents are prepared by the technical center:

The company must also have:

For individual entrepreneurs, it is mandatory to submit a certificate of registration as an individual entrepreneur. If such a person has a seal, it is worth taking it for registration.

Some tax authorities may require a document that confirms the absence of debt.

Vmenenschiki are not required to register the apparatus in the tax authority. The machine can be used without ECLZ. It will also not be necessary to provide the representative of the checking authority with the journal of the cashier-operator.

The main task of using technology is to supply data that can ensure the quality of internal accounting.

Often KKM without registration is configured to issue documents that are issued when settling with citizens.

The check must contain mandatory details and must be signed by the cashier. The registration process itself is no different. It will be necessary to collect documents and conclude an agreement with the CTO.

The entrepreneur or his authorized representative can register the device. In the first case, a passport is submitted, in the second, in addition to an identity card, it is also necessary to have a power of attorney.

The Federal Tax Service will control whether the cash discipline of the IP is carried out correctly, whether the profits received are fully accounted for. A fine is imposed:

The application is drawn up in the form that is approved. It is submitted on paper, but may also be in electronic format.

If the machine is not registered, the separate division will not be able to use it. Such conclusions are reflected in.

There is an offense if KKM is used, which is registered with another legal entity. And by the way, when transferring the apparatus to a structural unit, the enterprise must draw up an appropriate administrative act.

Representatives of the subdivision can register KKM using the software for entering and generating a file in the format of transferring information about the application for registration of the device.

Starting from 2018, almost all commercial organizations are switching to the latest generation of CCPs. New equipment is subject to mandatory registration and registration with the tax authority.

Preparation of documents for registration of KKM in the Federal Tax Service

The state register of cash registers includes models of online cash desks suitable for the new working conditions. Modern technology is equipped with internal memory - a fiscal drive. Information on cash transactions is recorded on the FN and sent to the regulatory authorities.

Before registering a cash register, you must perform a number of actions:

- Registration of a separate qualified electronic signature (QES).

- Conclusion of an agreement with OFD. The IFTS website provides a list of recommended operators.

- Preparing an application with data:

- details of the legal entity;

- type of activity of the organization;

- OGRN;

- technical passport of KKT;

- number of the agreement with OFD;

- passport data of the head;

- a power of attorney, if registration is carried out by a deputy or other responsible person.

Registration of KKM in the IFTS will take no more than 2 hours.

Registration procedure

Registration of KKM is carried out in two ways:

- online registration;

- personal visit to the tax office.

The first option is considered the most optimal. Online registration is quick and easy. The procedure is as follows:

- Authorization in the personal account of the taxpayer.

- Filling out and sending an application for registration of KKM. All fields must be filled in carefully.

- Automatic receipt of the registration number of cash registers.

- Fiscalization of cash registers by the forces of involved specialists.

- Registration of the cash register in the OFD personal account.

- Obtaining an online cash register registration card from the tax authority.

The equipment is ready to go! Further, all cash transactions are transferred to the OFD online. The operator checks the received information. The processed data is entered into a common database for storage. The tax service has the opportunity to check the legitimacy of receiving revenue at any time.

It is not necessary to purchase a new cash register. There is an option for upgrading existing equipment if the KKM model is included in the state register. In this case, the CCP registration process involves deregistration of old equipment and registration of updated equipment.

Registration of KKM in Avangard Service

The CCP registration procedure requires a certain amount of time. The Avangard Service company has been selling cash registers since 2005. The organization provides a range of other services, in particular legal support. We accept orders for registration and registration of new equipment.

Benefits of working with us:

- Ordering the service "Registration of KKM in the Federal Tax Service" on the spot or remotely. It is enough to call the phone number.

- All operations for registering cash registers are carried out on the basis of a power of attorney from the head of the customer enterprise or in the presence of an EDS.

- A bilateral agreement is drawn up. A package of documents with the signature of the head is taken by our courier.

- Any form of payment for the service: cash and bank transfer.

- Specialists register KKM, perform fiscalization, registration in OFD, receive a registration card.

- The term of registration is about 2 hours (if documents are available).

- The contractor informs the client about the end of the procedure. The finished CCP is picked up by a representative of the customer organization. Courier delivery is possible.

Using the services of the Avangard Service company, you will get rid of possible errors in the process of registering an online cash register. Working with us, you save time by receiving qualified legal assistance. Leave a message in the feedback form. Our specialist will advise you on all issues. We look forward to long-term cooperation!

Registration or re-registration of CCPs with the tax authorities is free of charge, in accordance with the procedure laid down in Art. In addition, in the part that does not contradict the provisions, they are applied (will cease to be effective from July 1, 2017), (hereinafter referred to as the Administrative Regulations) and by Order of the Federal Tax Service of Russia dated April 9, 2008 No. MM-3-2 / [email protected] " ".

To start working under the new rules, taxpayers need to purchase a cash register that meets the requirements for online cash registers, or upgrade an existing one. It is necessary to purchase a new CCP only for those users who use equipment that is incompatible with the new software and on which it is impossible to install a fiscal drive (FN). Information on the possibility of upgrading the CCP can be obtained directly from its manufacturer, or from an authorized CCP technical service center (CTO).

If the CCP can be upgraded, then it must first de-register with the tax office.

Before contacting the tax office to register the cash register, the user of the cash register must first solve some technical problems. In order to start working with an online cash register, taxpayers need to conclude an agreement for the processing of fiscal data with a fiscal data operator (FDO) and ensure that the cash terminal is connected to the Internet. Note that OFD is not entitled to refuse to conclude such an agreement with the user (). The new procedure for the use of cash registers does not require, when registering a cash register, the mandatory submission of an agreement on technical support for registerable cash registers with a technical service center.

Do you need an electronic signature?

Certification center GUARANTOR

will help you choose and purchase an electronic signature certificate for both legal entities and individuals.

After concluding agreements with an Internet provider and OFD, you can proceed directly to the registration procedures.

Previously, the procedure for registering a CCP required the physical presence of an entrepreneur in the tax office. Moreover, I had to visit the tax authority more than once. So, when registering a cash desk, it was necessary to first present it for inspection. Then, after filling in the necessary documents, it was necessary to go to the tax office again in order to receive a CCP registration card. Moreover, a year later it was necessary to bring the cash register back to the inspection in connection with the replacement of the ECLZ. Now all the necessary registration actions can be carried out through the CCP office on the nalog.ru website, without the need to appear in person at the tax office. However, for this, the user will need an enhanced qualified electronic signature. Access to the CCP cabinet can be obtained through the personal accounts of organizations and individual entrepreneurs on the website of the Federal Tax Service of Russia (nalog.ru).

The procedure for registering cash registers is enshrined in.

If the user decides to register an online cash desk remotely, he will need to send an electronic application for registration of the CCP to the tax office through the CCP office.

The application for registration of cash registers, regardless of the form of its submission to the tax authority (electronic or paper), must contain the following information:

- full name of the user organization or last name, first name, patronymic of the IP user;

- TIN of the user;

- address (when calculating on the Internet - the address of the user's website) and the place of installation (application) of the CCP;

- name of the CCP model and its serial number;

- FN model name and serial number;

- number of the automatic settlement device (in the case of CRE being used as part of an automatic settlement device);

- information on the use of a registered CCP in a mode that does not provide for the mandatory transfer of fiscal documents to the tax authorities in electronic form (if such a mode is applied);

- information on the use of a registered cash register equipment only when providing services (in the case of registering an automated system for BSO);

- information on the use of a registered CCP only when making settlements using electronic means of payment on the Internet (in the case of registering a CCP intended for use only when making such settlements);

- information on the use of CCPs when carrying out the activities of a bank paying agent or paying agent, when accepting bets and paying out funds in the form of winnings when organizing and conducting gambling (in the case of registering a CCP intended for use in carrying out such activities) ().

At the same time, the user, no later than one working day after submitting the application, must, by means of the CCP, write in the FN:

- CCP registration number received from the tax authority;

- full name of the user organization or last name, first name, patronymic of the IP user;

- information about CCP, including FN.

After receiving an electronic application, specialists of the Federal Tax Service of Russia within one working day will check the serial numbers of the fiscal accumulator and cash register specified in the application for their presence in the registers and send the user the registration number of the cash register, which will be unchanged throughout the life of the cash register. It should be noted that a cash register equipment, information about which is not available in the register of cash register equipment, as well as a cash register equipment that has an FN installed and not registered in the register of fiscal accumulators, are not subject to registration.

This number, as well as other information specified by law, the user, using the cash register itself or the computer cash system, which includes the cash register, must write it to the fiscal drive and generate a registration report, which will be sent by the cash register to the tax authority. The report can also be submitted on paper. All this must be done by the owner of the online cash desk no later than one working day from the moment he receives the registration number of the cash register. And the date of submission of the report in electronic form is the date of its placement in the CCP office or its transfer to the fiscal data operator. As a result, information about a particular cash register and its user will be reflected in the accounting register of the cash register of the Federal Tax Service of Russia (,).

The information provided by the user in the application for registration of CCPs will be entered by the tax inspectorate into the register and registration card of the CCP ().

At the end of the registration activities with the cash register, the tax authority will send the electronic card of the cash register registration to the user. This document is formed in the form of a document signed with an electronic signature and sent by the tax authority to the user's address within five working days from the date of completion of registration through the CCP cabinet or through OFD ().

A user who has received a CCP registration card in the form of an electronic document is entitled to receive a corresponding card on paper from the tax authority ().

Thus, already now all registration actions can be performed remotely - without visiting the tax office directly.