Accounting for monetary documents. How can a budget organization take into account the issuance and write-off of postal envelopes? How to write off postage stamps in a budget organization

Are envelopes monetary documents?

Based on the analysis of the norms of paragraph 107 of the Budget Accounting Instructions, which was approved by Order of the Ministry of Finance of Russia dated December 30, 2009 No. 148n, stamped envelopes should be taken into account as part of monetary documents (although only stamps are directly named in this regulatory act). Therefore, envelopes with stamps affixed to them should only be kept at the institution’s cash desk.

Features of cash transactions

Any movement of marked envelopes is reflected in the institution's Cash Book (f. 0504514). The basis for making entries in it are cash orders: incoming stock orders (f. 0310001) are used when envelopes are received at the cash desk and outgoing stock orders (f. 0310002) are used when issuing them from the cash register. They are registered in the Journal of Registration of Incoming and Outgoing Cash Documents (f. 0310003) separately from transactions with other funds.

The purchased stamped envelopes are accepted for reporting by the cashier (including on the basis of the invoice received from communication institutions).

Accounting for transactions with monetary documents is kept on separate sheets of the Cash Book (separate from transactions with cash). However, a single continuous and sequential numbering of sheets is preserved.

Note that in accordance with the letter of the Central Bank of the Russian Federation dated August 28, 2007 No. 29-1-1-10/3669, the cashier of the institution requires the cashier of the institution to daily display the balance of cash in the cash register in the Cash Book and submit a cashier’s report to the accounting department. The letter from the Bank of Russia says nothing about monetary documents. Therefore, it can be assumed that if there is no movement of monetary documents, it is not necessary to withdraw the balance on them daily to the cashier of the institution. Control over the correct maintenance of the Cash Book rests with the chief accountant of the institution.

Issuance of monetary documents

The cashier hands over the marked envelopes for use to financially responsible persons who are responsible for the design, issuance and use of envelopes for reporting.

In addition to cash documents, an invoice is drawn up or transactions are recorded in the Issue Journal for reporting cash documents. It should reflect the following data:

- date of issue of monetary documents;

- surname, name, patronymic of the person to whom they are issued;

- number of stamped envelopes issued;

- the cost of issued monetary documents;

- signature on receipt.

Reasons for writing off envelopes

Marked envelopes are usually issued for a period of no more than a month (the specific period is established in the accounting policy of the institution) on the basis of a memo issued to the head of the institution. The note indicates the required number of marked envelopes, as well as information about the debt on marked envelopes issued earlier.

Upon expiration of the established period, the accountable person fills out an Advance Report (f. 0504049), in which he describes the data on the issued marked envelopes in quantitative and cost terms.

The accountant recognizes expenses for monetary documents only after documentary confirmation of their sending by mail.

Analytical accounting

Please note that analytical accounting is carried out by type of marked envelopes and their value in the Funds and Settlements Accounting Card (f. 0504051). In this case, operations on the movement of marked envelopes are reflected in the Journal for other operations.

Accounting records

Expenses associated with the purchase of marked envelopes are reflected under subarticle 221 “Communication services” (Instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance of Russia dated December 25, 2008 No. 145n). The envelopes themselves are accounted for in account 201 35 000 “Cash documents”.

Transactions with marked envelopes are reflected in the following entries:

| Contents of operation | Debit | Credit |

|---|---|---|

| Advance payment for stamped envelopes has been transferred (Application for cash expenses) | 206.21 560 “Settlements for advances for communication services” |

201.11 18.01 610 “Institutional funds in personal accounts with the treasury authority” |

| Marked envelopes were capitalized at the institution's cash desk (PKO stock) |

201.35 510 "Money documents" |

302.21 730 "Calculations for communication services" |

| Advance payment is credited when accepting stamped envelopes for accounting (automatic credit of advance payment) |

302.21 830 "Calculations for communication services" |

206.21 660 “Calculations for advances for communication services” |

| Marked envelopes were issued to the accountable person (RKO stock) |

208.21 560 |

201.35 610 "Money documents" |

| The cost of spent stamped envelopes has been written off (advance to the accountable person) | 109.71 221 “Overhead costs” |

208.21 660 “Settlements with accountable persons for payment for communication services” |

| Return of unused stamped envelopes (PKO stock) | 201.35 510 “Cash documents” |

208.21 660 “Settlements with accountable persons for payment for communication services” |

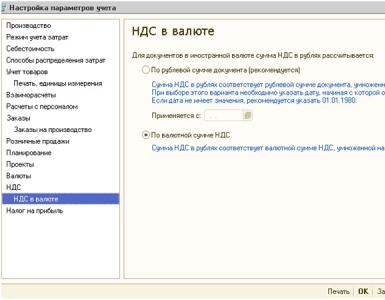

Let's reflect these operations in the 1C: Public Institution Accounting 8 program:

1. Advance payment for stamped envelopes is listed. Operation “Advances to suppliers”, the recipient of the payment is the Federal State Unitary Enterprise Russian Post. We purchase stamped envelopes for the amount of 2000 rubles.

2. Marked envelopes are credited to the institution's cash desk. The document is a cash receipt order. Operation - acquisition of monetary documents.

3. Marked envelopes are issued to the accountable person. Document - Expenditure cash order. Operation - issuance of documents from the cash register for reporting.

As a result of posting the document, we receive the following transactions:

4. The cost of spent stamped envelopes has been written off. Documents - Advance to an accountable person, Advance report tab, accounting transaction.

5. Return of unused stamped envelopes. Document - Receipt cash order, operation - Return of cash from the accountable person.

Stukacheva Victoria,

Consultant at ANT-HILL Company

The company is on a traditional taxation system. The procedure for recording marked and unmarked envelopes in accounting?

Record unmarked envelopes as part of office supplies (account 10), and write off marked envelopes as part of monetary documents and when used in activities on the basis established in the accounting policy (clause 4 of Article 252 of the Tax Code of the Russian Federation).

In tax accounting, the costs of purchasing unmarked envelopes can be taken into account as the costs of purchasing office supplies, i.e. as part of other expenses associated with production and (or) sales (subclause 24, clause 1, article 264 of the Tax Code of the Russian Federation). Grounds – (see Decision of the Moscow Arbitration Court dated 08/17/2006, 08/18/2006 No. A40-10124/06-90-55).

But in the Decisions of the Moscow Arbitration Court dated November 23, 2005, December 5, 2005 No. A40-55022/05-99-343, dated July 6, 2005 No. A40-15236/05-114-111, the courts indicated the possibility of the taxpayer using subparagraph 49 paragraph 1 of article 264 of the Tax Code of the Russian Federation.

By virtue of subparagraph 25 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include, among other things, expenses for postal services.

For example, in the Resolution of the Thirteenth Arbitration Court of Appeal dated 08.08.2007 No. A56-51990/2006, the court found that, as evidence of expenses incurred, the taxpayer presented advance reports and invoices with a post office stamp indicating the number and cost of stamps sold. As the court indicated, these documents are adequate evidence of expenses incurred. Therefore, marked envelopes in accounting should be reflected as part of monetary documents:

Debit 50-3 Credit 71 (60...)

– received (purchased) marked envelopes;

Debit 71 (73, 26, 91-2...) Credit 50-3

And in tax accounting, choose the basis for recognizing expenses. If some expenses can be attributed simultaneously to several groups of expenses with equal grounds, the taxpayer has the right to independently determine which group he will assign such expenses to (Clause 4 of Article 252 of the Tax Code of the Russian Federation).

The rationale for this position is given below in the materials of the Glavbukh System vip version

Recommendation: How to organize accounting of monetary documents

What applies to monetary documents?

Monetary documents include:

– travel documents (air and train tickets, as well as public transport passes);

– cash coupons for gasoline;

– vouchers purchased by the organization;

- stamps;

– other similar documents.

Securities purchased from other companies: shares, bonds, bills, etc., do not qualify as monetary documents. The obligations associated with them must be taken into account on account 58 “Financial investments”, and not on account 50 “Cash”. This is stated in paragraph 3 of PBU 19/02.

Monetary documents should be distinguished from strict reporting forms. Typically, monetary documents are drawn up on strict reporting forms, and their difference from forms is that they indicate that payments between the parties have already been made, and in some cases they are a document confirming this. For example, in the accounting of an organization that purchased air tickets, they will be reflected in account 50-3. And forms of air tickets that have not yet been issued from the company selling them will be taken into account as strict reporting forms in account 006.

Storage of monetary documents

Keep monetary documents in the cash register along with cash. In accounting, transactions with monetary documents are reflected in special subaccounts to score 50-3"Cash documents" ( Instructions for the chart of accounts). For example, to account for airline tickets, you can use score 50-3 sub-account “Travel Documents”, etc.

Reflect the receipt and disposal of monetary documents by postings:*

Debit 50-3 Credit 71 (60...)

– received (purchased) monetary documents;

Debit 71 (73, 91-2...) Credit 50-3

– monetary documents were issued to the employee (on account) or written off as expenses.

The procedure for reflecting VAT related to purchased monetary documents depends on how the primary documents for their acquisition are drawn up. If VAT is highlighted in a monetary document or the document arrived with an invoice, then take into account the tax separately on count 19"VAT on purchased assets". Take into account the monetary document itself score 50-3“Cash documents” at actual cost ( Instructions for the chart of accounts).

If the VAT amount is not highlighted in a monetary document, then it is also not highlighted in accounting and is not taken into account separately ( Instructions for the chart of accounts , letter from the Russian Ministry of Finance dated 10 January 2013 city no. 03-07-11/01 ).

For information on how to take into account VAT allocated in a received invoice if the deduction conditions are not met, see How to reflect VAT in accounting and taxation .

Accounting for the movement of cash documents

Situation: how to arrange the issuance of monetary documents to employees (accounted for in account 50-3)

Prepare the issuance of monetary documents to employees according to a statement developed independently.

All business transactions must be documented with primary documents ( P. 1 tbsp. 9 of the Law of 6 December 2011 city no. 402-FZ). However, there is no special form for recording monetary documents issued to employees. So develop it yourself. For example it could be statement (book) of accounting for the movement of monetary documents. It can be compiled in any form, but it must contain all the necessary details listed in paragraph 2 Article 9 of the Law of December 6, 2011 No. 402-FZ.*

Situation: how to reflect in accounting transactions for the purchase of waste disposal coupons: as monetary documents or as advances issued

Expenses made by a budgetary institution for the purchase of unmarked envelopes should be taken into account under the article On the increase in the cost of supplies. The result of this conclusion was the procedure for using the classification of budget expenditures of the Russian Federation, which was approved by order of the Ministry of Finance. According to this order, services provided by postal services, as well as the purchase of stamps and envelopes and forms with markings, should be classified under the article Communication services.

It should also be remembered that, according to the instructions on the application of the general plan for accounting accounts, all postage stamps, as well as envelopes with markings and forms with similar marks, are related to documentary acts for monetary equivalents, and, therefore, must be taken into account in the account for monetary documents . The cost of a monetary document is reflected in budget accounting. At its core, this price is fully equivalent to the size of assets or non-financial services that can be provided outside of violations of the relevant contract.Expenses of cash value are generated in budgetary accounting in case of the acquisition of monetary documentary acts, and actual expenses for the current financial year can be generated only after they have been completed. If envelopes without markings are purchased, then there can be no talk of any payment for postal services. Therefore, there is no reason to attribute such expenses to postal services.

According to the existing rule, expenses for the purchase of items that in the future, according to the instructions of the instructions, can be included in the composition of active assets of a non-financial nature, should be attributed to suitable items from the group of income of non-financial active assets. But expenses for the purchase of items relate to fixed assets and are made under the article on the increase in the cost of fixed assets, and expenses for the purchase of items that belong to material supplies are addressed to the article on the increase in the cost of material supplies.

The requirements for items purchased for the needs of the organization to be fixed assets must comply with instruction 157 and its subparagraphs 38-39, 41, 99. The essence of these subparagraphs comes down to the fact that unmarked envelopes cannot belong to fixed assets. For this reason, unmarked envelopes may be recorded as inventory, and the expenses incurred to purchase them should be charged to the Increase in Inventory item.

This is the conclusion that independent experts considered to be the most justified; the correctness of this interpretation was confirmed by judicial practice. Therefore, such expenses, even in previous years, should be documented in a similar way.

Source: blagosti.ru

As you know, a computer is not a single unit, it is a monitor plus a system unit, keyboard, and mouse. This is the standard set of elements. How in practice is it customary to keep records...

Accounting for limits or restrictions on budgetary obligations requires authorization for spending on all debts and appropriations. For correct and correct filling...

A budget organization is a non-profit institution that was organized by the state for the purpose of performing a certain type of work or providing a certain type of...

For the collection of libraries of both state and municipal importance, there are general rules for counting, and neither the status, nor the structuring of the fund, nor...

Accounting for monetary documents

The activities of any institution often use documents such as coupons for gasoline or food for students, postage stamps and stamped envelopes for sending correspondence, express payment cards for the Internet and cellular telephone communications and other documents that require special accounting. In this article we will look at the order in which they should be used and taken into account.

What are monetary documents

Monetary documents are documents acquired and stored in an institution and having some value. Settlements for their acquisition between the parties have already been made, but the services that can be obtained with the help of these documents have not yet been provided.

According to p. 169 Instructions No.157n paid coupons for gasoline and oil, food, paid vouchers to holiday homes, sanatoriums, tourist centers, received notices for postal orders, postage stamps, stamped envelopes and state duty stamps - all these are monetary documents.

Cash documents must be kept in the institution's cash office.

In accordance with paragraph 170 Instructions No.157n The receipt and issuance of such documents from the cash register are documented as receipts (f. 0310001) and expenditure cash orders (f. 0310002) with the entry “stock” placed on them.

Incoming and outgoing cash orders with the entry “stock” are registered in the register of incoming and outgoing cash documents separately from incoming and outgoing cash orders, which record transactions with funds.

In the cash book (f. 0504514) of the institution, records of transactions with monetary documents are kept on separate sheets, on which the mark “stock” is affixed.

According to the guidelines for maintaining a cash book, approved By Order of the Ministry of Finance of the Russian Federation No.173n, the total indicators of transactions for the day and the balance indicators at the end of the day are formed for cash and for monetary documents separately. In the sheets of the cash book containing data on the movement of monetary documents, the lines “including wages” and “total cash balance at the end of the day” are not filled in.

Entries in the cash book must be made by the cashier immediately after receiving or issuing cash documents for each stock receipt and stock debit order.

Accounting for transactions with monetary documents is kept in the journal for other transactions on the basis of documents attached to the cashier’s reports ( paragraph 172 Instructions No.157n).

Reflection in accounting of the movement of monetary documents

Let's look at examples of how various types of monetary documents are used in educational institutions and how the facts of economic life carried out with their help are reflected in accounting. Specific recommendations for accounting for certain types of monetary documents have not been developed at the federal legislative level, therefore, in our opinion, the procedure for their use and reflection in accounting must be fixed in accounting based on the specifics of the institution.

Food vouchers for students. There is a category of students to whom the educational institution is obliged to provide free meals. This type of food is provided through food stamps. The coupon can be printed or printed. It must contain a number of mandatory details:

Individual number;

Validity;

Type of food;

Amount (cost);

Seal or stamp of the issuing organization and signature of the employee.

For municipal institutions in some regions, rules for the circulation of certain types of monetary documents have been created. A clear procedure for issuing and recording coupons for the provision of meals on a preferential basis in educational institutions has been developed, for example, by the Government Education Committee ( Order No. dated 06/08/20091139-r).

According to this document, educational institutions are supplied with uniform coupons. Head of the institution

ensures the storage of coupon forms and issues them to the employee responsible for catering, in accordance with the number of students in preferential categories. The coupon forms are transferred according to an act, the form of which has been specially developed and is given in Appendix 3 to this order. This employee issues the completed coupon forms to the teacher performing the function of the classroom teacher or the industrial training master (group supervisor). Tickets issued but not used will be returned. All actions with coupons must be recorded in the coupon issuance book, the form of which is given in Appendix 2 to The procedure for issuing and recording coupons, approved by Order No. 1139-r.

When providing preferential meals by the educational institution itself, the coupons used for their intended purpose are counted at the end of each working day and attached to the cash report. They are stored together with cash register documentation for five years and after the expiration of the storage period they are destroyed by order of the head of the institution.

When providing preferential meals in a public catering establishment, a weekly verification of the use of coupons is carried out and a corresponding act on their implementation is drawn up in the form given in Appendix 3 to the Procedure for issuing and accounting for coupons.

A state-owned educational institution with a catering company for the supply of breakfasts and set lunches for students. The institution paid 120,000 rubles under the agreement. Food stamps were received for this amount according to the acceptance certificate. They were entered into the cash register as monetary documents. Part of the coupons from the cash register in the amount of 30,000 rubles. was transferred to an accountable person who issued these coupons to students. After the students received meals according to these coupons, a statement was drawn up in the amount of 30,000 rubles. (attached to the advance report of the accountable person who received the coupons).

According to Order of the Ministry of Finance of the Russian Federation No. 171n, expenses of a state institution for payment for services for organizing hot meals for students are included in subarticle 226“Other works, services” KOSGU.

These transactions will be reflected in the accounting records of the institution in accordance with Instruction No. 162n as follows:

According to the corresponding synthetic accounting code.

Coupons for fuel and lubricants. Let's consider the option when an institution is provided with fuel and lubricants using coupons: under an agreement, a certain amount of gasoline of the appropriate brand is paid, and the institution receives coupons with which drivers will refuel cars at gas stations.

The received coupons on the basis of the supplier's shipping documents (invoice, etc.) are received as monetary documents at the institution's cash desk, and in the receipt order it is advisable to indicate the brand of gasoline, the series and numbers of these coupons, the denomination of the coupons in liters and the cost of the coupon in rubles (based on the cost of gasoline specified in the contract and invoice).

As necessary, coupons for the right to receive fuel are issued to drivers or a specially designated employee for reporting.

Usually, for control purposes, a special accounting book is opened in which the movement of coupons is recorded.

The fuel received using coupons is accounted for as the institution’s inventory after the submission of an advance report by the accountable person with supporting documents from the gas station that sold the fuel in exchange for the coupon.

A budgetary educational institution, as part of its activities to fulfill a state (municipal) task, received from the supplier coupons for 1,000 liters of AI92 gasoline in the amount of 28,000 rubles. The denomination of the coupon is 20 l worth 560 rub. Issued to the accountable person

2 coupons, for which it refueled the car, after which it submitted an advance report.

These transactions will be reflected in accounting in accordance with Instruction No. 174n in the following way:

Express payment cards for cellular communications and Internet. Employees of institutions often use corporate mobile communications or receive compensation for using their own communications equipment for business purposes. A widely used type of payment for mobile communications and the Internet is express payment cards, which are purchased by an institution and must be recorded as monetary documents.

To ensure that inspectors and tax authorities do not have any questions about the legality and advisability of paying for cellular communications, the institution needs to develop an appropriate

governing regulation (internal regulatory act). This document should contain a list of employee positions that are eligible to receive cellular payment cards, and the conditions that must be met (for example, employees are paid only for calls made during working hours, or it is also possible to pay for calls made outside of working hours (during weekend)). It is advisable to prescribe the procedure for employees to confirm their expenses for cellular communications (providing details of negotiations and an employee memo about which calls were business calls).

An autonomous institution, using funds from income-generating activities through an accountable entity, purchased 100 express payment cards with a nominal value of 100 rubles. for a total amount of 10,000 rubles. These monetary documents were accepted at the institution's cash desk. The deputy was given 3 payment cards for reporting. The accountable person submitted an advance report with supporting documents.

Costs for the purchase of payment cards for mobile phones in accordance with Order of the Ministry of Finance of the Russian Federation No. 171n are included in subarticle 221"Communication services" KOSGU.

In accounting, these transactions will be reflected in accordance with Instruction No. 183n in the following way:

Postage stamps and stamped envelopes. Despite technological progress, postal services still remain relevant and in demand. The organization of postal shipments is impossible without purchasing stamps and marked envelopes, which, according to Instruction No. 157n, must be taken into account as monetary documents. A typical accounting error is the immediate write-off of purchased envelopes and stamps. For example, how can you justify writing off 200 envelopes at once, even if 20 letters were actually sent in a month? They must be taken into account as monetary documents and, as necessary, issued for reporting to persons responsible for sending correspondence, who must draw up an advance report and attach supporting documents to it. Such documents may be a register of sent correspondence, and in case of damage, a damaged envelope attached to the report.

Acceptance for accounting and issuance of postage stamps and stamped envelopes will be reflected in accounting as follows:

|

State institution (Instruction No. 162n) |

State-financed organization (Instruction No. 174n) |

Autonomous institution (Instruction No. 183n) |

|||

|

Receipt of stamps and stamped envelopes to the institution's cash desk |

|||||

|

0 201 35 510 |

0 302 21 730 0 208 21 660 |

0 201 35 510 |

0 302 21 730 0 208 21 660 |

0 201 35 000 |

0 302 21 000 0 208 21 000 |

|

Issuance of stamps and marked envelopes for reporting |

|||||

|

0 208 21 560 |

0 201 35 610 |

0 208 21 560 |

0 201 35 610 |

0 208 21 000 |

0 201 35 000 |

Travel tickets. According to Art. 166,168.1 Labor Code of the Russian Federation For employees whose permanent work is carried out on the road or is traveling in nature, the employer reimburses travel expenses associated with business trips.

According to labor legislation, the amount and procedure for reimbursement of expenses associated with business trips of employees, as well as the list of jobs, professions, and positions of these employees are established by a collective agreement, agreements, and local regulations. In an educational institution, payment for a travel ticket can be made to a social teacher whose work involves traveling (visiting students at their place of residence, traveling to participate in meetings of various commissions and councils, etc.).

Based on Order of the Ministry of Finance of the Russian Federation No. 171n, the expenses of an institution for the purchase of travel tickets for employees whose work is traveling in nature are attributed to subarticle 222"Transport services" KOSGU.

A government educational institution purchased a bus ticket worth 950 rubles. as of September 2013 for a social teacher. Payment for the travel ticket was made non-cash at the expense of budget funds. The travel ticket was entered into the institution's cash office and issued to the teacher for reporting. At the end of the month, the teacher submitted an advance report with an already used travel document attached to it.

In the accounting of a government institution, these transactions must be reflected in accordance with Instruction No. 162n as follows:

Lack of cash documents at the cash desk

The procedure for conducting cash transactions with banknotes and coins of the Central Bank of the Russian Federation on the territory of the Russian Federation is regulated Regulation No.373-P. According to clause 1.11 of this provision, measures to ensure the safety of cash during cash transactions, storage, transportation, as well as the procedure and timing of verification of the actual availability of funds are determined by the legal entity. This means that the procedure for checking the cash register and cash transactions is established by local regulations, for example, regulations on internal control, accounting policies, regulations on cash transactions. During control activities, in addition to a complete recalculation of cash at the cash desk, other valuables stored in the cash register, including monetary documents, are also checked.

To reflect the results of the inventory of monetary documents located at the institution's cash desk, an inventory list (matching sheet) of forms and monetary documents is used (according to f. 0504086, approved by Order of the Ministry of Finance of the Russian Federation No. 173n).

During an inspection at the cash desk of a budgetary institution, a shortage of monetary documents was revealed - 2 express payment cards with a nominal value of 100 rubles each. each purchased through a subsidy for the implementation of a government task. The person responsible for this shortfall and the amount of the shortfall was repaid by him voluntarily in kind.

The institution must record the situation that has arisen in accordance with paragraph 86, 87 , 109 , 110 Instructions No. 174n in the following way:

Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

Order of the Ministry of Finance of the Russian Federation dated December 15, 2010 No. 173n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, and Guidelines for their use."

The procedure for issuing and recording coupons for the provision of meals on a preferential basis in educational institutions of St. Petersburg.

Order of the Ministry of Finance of the Russian Federation dated December 21, 2012 No. 171n “On approval of the Instructions on the procedure for applying the budget classification of the Russian Federation for 2013 and for the planning period of 2014 and 2015.”

Instructions for using the Chart of Accounts for Budget Accounting, approved. By Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

Question: The state institution purchases postal envelopes with the letter “A”, that is, with stamps applied in a typographical manner, and not pasted on. Are these marked envelopes monetary documents? Do they need to be brought to the institution’s cash desk? If they are monetary documents, then what is the deadline for issuing these envelopes for reporting? Can they be issued for a period of, for example, 1 month?

Reply from 04/23/2015:

Postal envelopes with the letter "A", that is, with stamps applied in a typographical way, are a means of payment for postal services, therefore they are rightfully considered monetary documents. They should be received at the stock desk using a stock receipt order and issued for reporting purposes according to a stock expense order.

Debit of account 1.20135.510 - Credit of account 1.30221.730 - receipt of envelopes to the stock desk from the supplier

Debit of account 1.20135.510 - Credit of account 1.20821.660 - receipt of envelopes to the stock fund when purchased through an accountable person

Debit account 1.20821.560 - Credit account 1.20135.610 - issue envelopes to employee for reporting

The deadline for which envelopes are issued to an employee for reporting may be established by order of the manager, or may be stipulated in the accounting policy in the section regulating the procedure for document flow. You should also, when issuing envelopes for a report against signature, notify the reporting employee about the deadline for issuing the envelopes (indicate the issuance date in the expenditure stock order), since the reporting person is not required to know all the orders of the manager and accounting policies.

When determining the deadline for which report envelopes will be issued, one should proceed from the average daily need for envelopes, as well as from the employee’s ability to ensure their safety. If, for example, such an employee does not have a safe (other tamper-proof storage), it is unreasonable to give him more envelopes than necessary for a day of work. If an employee has the opportunity to store them for a long time, the accounting policy should provide for the possibility of a planned and sudden inventory of the current balance of envelopes.

Instructions, approved. Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n) does not determine what primary documents an accountable person can use to confirm expenses incurred. Therefore, it is necessary to determine in the accounting policy what primary documents the employee will use to report on the use of envelopes. This could be, for example, a register of sent correspondence. The form of such a primary document must comply with the requirements for the presence of mandatory details given in